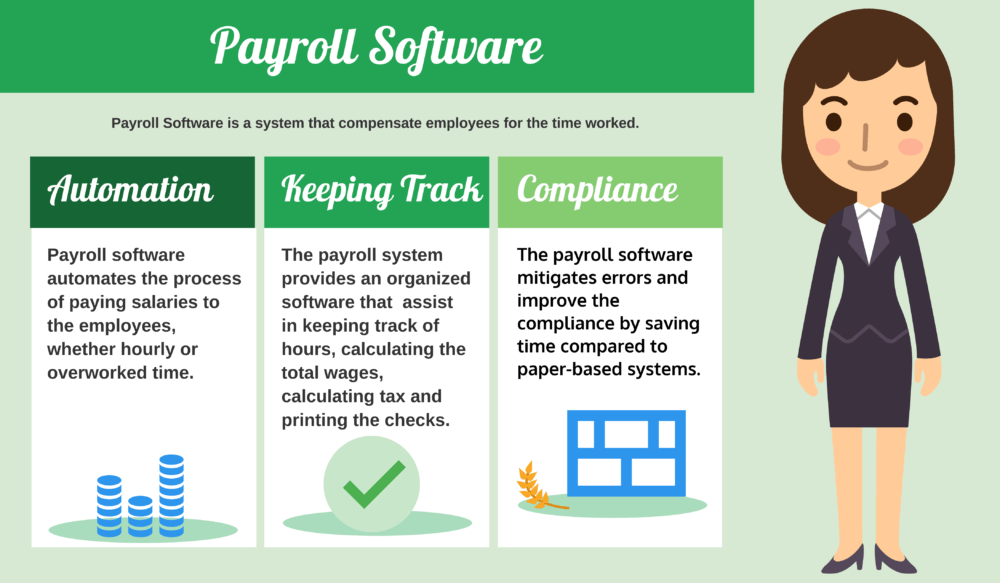

What is Payroll Software?

Payroll software facilitates payroll processing, reducing the burden for your company on this practice. This secure electronic system is used by organizations to access and update employee information, custom reports, and more. This means that calculating and paying wages, wages, taxes and super time is less time. Data automation also leads to fewer errors. So, let’s get to know about payroll software.

What Are the Main Features about Payroll Software?

Having an efficient payroll system with customizable parameters and an intuitive user interface is a great way to streamline your business operations. It also helps you ensure that you pay employees accurately and on time.

- The payroll software you choose should provide flexible tools that can be scaled to your organization’s growth. The software should be easy to use and have a clutter-free user interface. It should also be mobile-friendly.

- Expense management is another important feature of payroll software. Automated expense management ensures reimbursements for remote workers are accurate. Also, it can streamline your payroll processing by eliminating data entry for each employee.

- Most payroll systems include self-service capabilities. This allows employees to access their payroll checks online, request credit, and change deduction amounts. These features make life easier for HR executives and administrators.

- Many payroll systems also include workflow notification features. This makes it easy to generate almost any report. It can also help you manage tax payments and keep your business in compliance with laws.

- Some payroll software systems also include payroll data analytics modules. These allow you to track local, national, and global payroll spending trends.

- You can also integrate your payroll system with accounting software. This can help you automatically calculate taxes due, file taxes, and notify you of changes to employment laws. These features can help you improve employee morale and boost your organization’s efficiency.

- When choosing a payroll software solution, make sure you choose a reputable vendor. These vendors tend to have longstanding clients and understand the laws and regulations of the industry. They also should offer seamless integrations and demonstrate their security measures.

Why does a business need payroll software?

You will need an efficient, automated payroll function, irrespective of the size of your company. Your employees are your best resource, so taking care of them makes sense.

- This involves: paying everyone accurately and on time in accordance with their award or agreement for employment.

- Fair and prompt processing of leave requests.

- Manage a successful monitoring program that awards staff salaries and bonuses. To prevent any serious problems, you need these processes to be smooth, quick and precise.

The payroll was a time-consuming and manual process up until recently. Thankfully, this was fixed by technology. You can perform many tasks using time and resource-saving automated programs.

Payroll Management Software helps you make payments on time for employees, create real-time reports, log times, and check wages, while transparently monitoring data.

How Does Payroll Software Work?

Using payroll software is a good way to ensure that your employees are paid on time and that all your deductions and taxes are properly calculated. It also takes the stress out of payroll processes. Payroll is one of the most critical aspects of any business. It is essential for maintaining the financial standing of your company. In addition, accurately calculating and paying employees boosts team productivity. But this can be a time-consuming process. When your workforce grows, payroll issues can arise. Manual payroll can lead to costly errors, which can be avoided with the use of payroll software.

Payroll software allows you to track employee hours worked and automatically calculate taxes and deductions. It also can automate the delivery of tax forms to employees. This software also can integrate with existing HR ecosystems and handle payroll-related perks and benefits.

If you are considering using payroll software, make sure to ask questions about pricing. Some providers may charge extra monthly fees. The cost of payroll software can vary according to the number of employees. It is best to opt for a plan that will make sense for your business.

Cloud-based payroll solutions are becoming more and more popular. They offer scalability and are cost-effective. They also provide mobility and security. Using a payroll solution ensures that your company stays in compliance with government regulations. Many payroll software vendors focus on providing employee-focused tools. This allows your HR department to focus on employee management instead of dealing with tedious payroll chores. Also, read about Third Party Payroll Software and Why Choose it? We also have the best payroll software in Chennai.

About the bottom line of payroll software?

- With less time than manual methods, automation processes data.

- Personnel are happier because payment delays and mistakes are not present and they can easily update their personal data, including bank, tax and pension information.

- The government is also satisfied, as reports are sent immediately without duplication by you. This ensures that the workforce is more efficient.

0 Comments