NITSO

Payroll Management Software

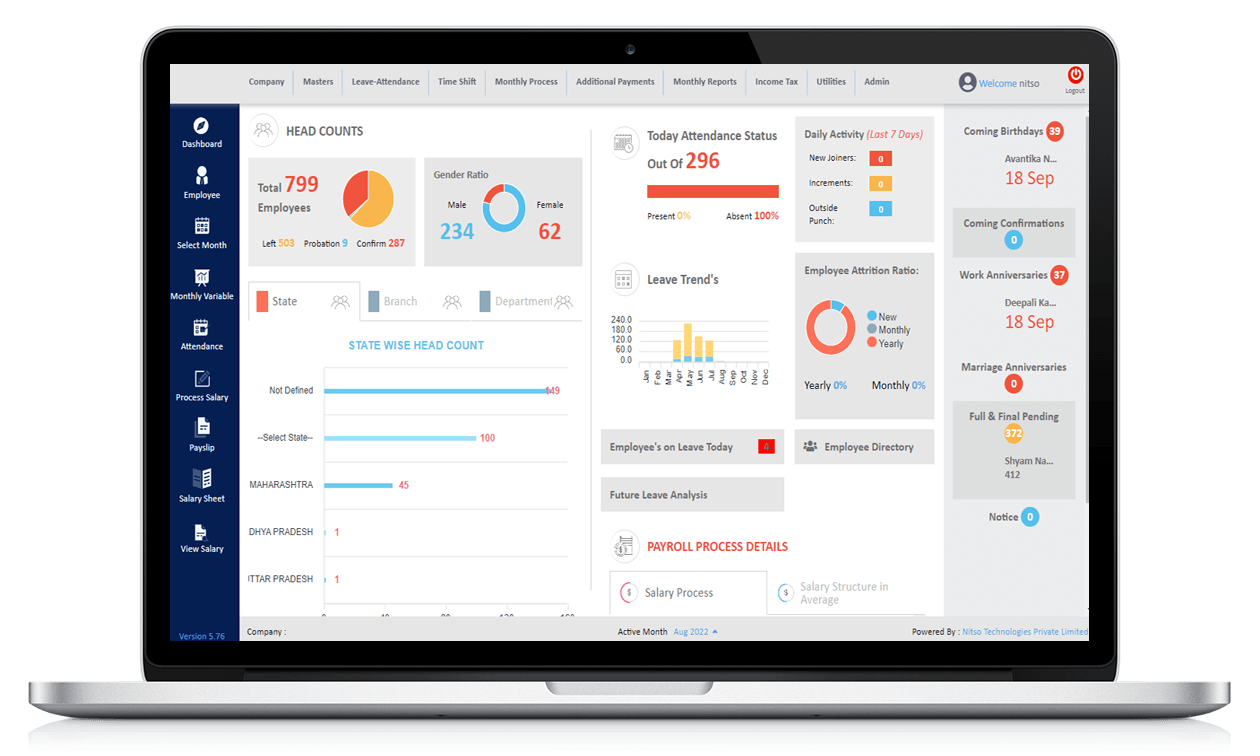

Nitso Payroll Specialist is quite an easy, flexible, and user-friendly form of the best Payroll Management software system in India that takes care of all your requirements related to the management of employees’ Payroll. This online payroll software offers user-defined Earning and Deduction Components using a Calculation Table. The cloud based payroll software generates all the outputs & statutory reports required by a Payroll application. Payroll Management Software covers all legal requirements such as PF, TDS, ESIC, and Professional Tax. Most of the legal calculations are parameterized in the online payroll software. Also best and most regular upgrades of our payroll software in India are provided for changes in statutory rules & regulations. Employee Payroll Management System helps in managing all Payroll & HR department activities like leave, attendance management, promotion & Transfers, salary generation, loan & advances, PF, ESIC & Income Tax.

Manage your HR payroll system at your fingertips with our Payroll Specialist. Our cloud based payroll software provides a complete solution to all your Payroll needs. Our best, easy, and most user-friendly payroll management software in India will enable you to process your employee’s and staff’s net salaries after adjusting all statutory deductions, incentives, overtime, etc. The Payroll Management system is compatible with easy customizations and regularly updated with the latest government rules, regulations, and standard industry practices. You can choose from both our Cloud-payroll and onsite Payroll system as you need.

Some functions of our online Payroll Software System are:

- $Seamless integration with any attendance management system for one-click payroll processing via payroll management system.

- $Easily Customizable can be done as per the business policy of the entities.

- $Automates all your Payroll related through a single window.

- $Our online Payroll Software can be customized as per the requirement of the Business.

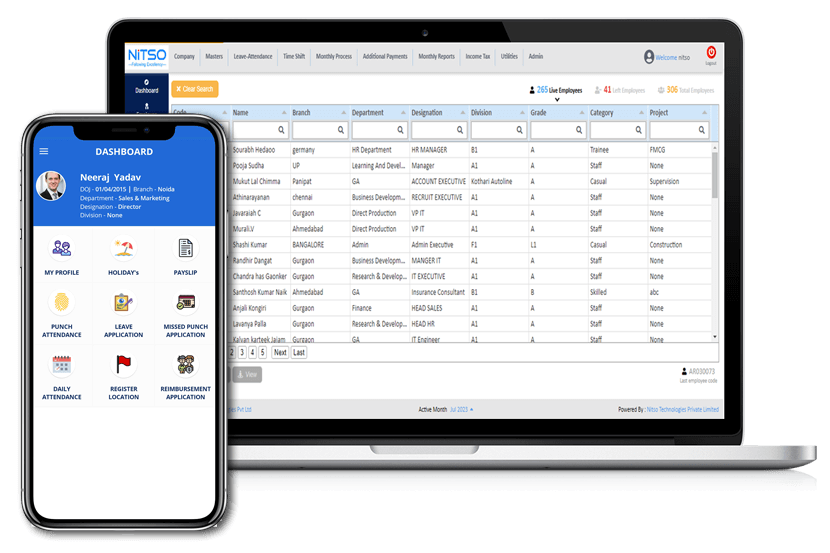

- $Employee Self-Service Portal.

- $Mobile App for Easy Access and Tracking.

Nitso Cloud-based Payroll Software and Onsite Employee Payroll Management System

Cloud Payroll Specialist

- $Very cost-effective for small Businesses as could be started with plans like per employee or per month.

- $Infrastructure and in-house experts are not required for setting up the payroll management software system.

- $Login and payroll generation can be easily performed via the web.

- $Web-based data is protected with high security.

Onsite/On-Server Payroll System

- $Flexible payroll management software is great for companies holding on over 50 employees or is dealing with complex payroll requirements.

- $Import data from Microsoft Excel with our Spreadsheet Import module.

- $Comprehensive reports are easy to produce.

- $Easy to use with reliable functionality.

- $The best payroll software in India offers you greater flexibility for managing complex payroll needs.

- $Handles multiple payments / deductions and guides the user through the payroll cycle.

See NITSO Payroll Software in action

LEARN HOW WE CAN HELP YOU EFFORTLESSLY MANAGE YOUR EMPLOYEES, WHETHER YOU HAVE A WORKFORCE OF 1 OR 10,000.

Payroll System Key Features

- $Flexibility to add or modify N number of Salary Components – Earnings & Deductions.

- $Calculation done on the payroll management software system is as per the Attendance.

- $Monthly or yearly releasing of payments.

- $Input information for all newly joined employees and resigned/left employees.

- $Creation of New Month & Salary processing.

- $Salary on Hold & Stop Salary option.

- $FNF Processing, Gratuity calculation & Leave encashment configuration.

- $Income Tax calculation as per rules.

- $Quarterly filing of 24Q.

- $Generation of Form16 for employees.

- $Reimbursement calculation, payments & bill submission.

- $Print Payslips for groups or selected employees.

- $Lock month facility to avoid changes in Processed Data.

- $Data importing can be done easily from Excel to our Employee payroll management system spreadsheet.

- $Report Writer to add / modify user-defined reports with available fields.

- $User-defined PF / ESIC rate of deduction for Employee and Employer.

- $PF applicability in our payroll management software India at the Employee level.

- $Complete drill-down of monthly salary, employee wise yearly salary details are available on the screen.

- $Output reports to screen and printer.

- $Multi-User / User Level Access.

Features of Other Modules in Payroll Management System

Salary Components/Heads

- $Flexibility to add n number of Earning/ Deduction Components

- $Components can be fixed or Formula based.

- $The Prorata calculation option is available on our online payroll software system.

- $Option to print in payslip (yes/ no)

Employee Management

- $Employee master details like Branch, Department, Grade & Designation.

- $Employee payment detail.

- $Personal details, Qualifications.

- $Family members & documents attachment.

- $Profile picture.

Loan / Advanced Payment

- $Facility to add any number of user-defined Loans and Advances.

- $Automatic recovery of Loan/Advances installment amount in salary processing.

- $Automatic interest calculation for Loans on the best payroll software in India.

- $Automatic calculation for Prerequisite (interest-free loan) for Tax Calculation.

- $Auto-stop of Installments will be performed by our payroll management system after complete recovery.

- Provident Fund (PF)

- Employees' State Insurance Corporation (ESIC)

- Professional Tax

- TDS with multi TAN Management

- Calculation of Employee & Employer part is offered during salary processing.

- PF Sheet/ Summary can be prepared on our payroll management software.

- Automatic preparation of ECR ( Electronic Challan Cum Return ) file for filing.

- PF Form 5, 10, Challan, 12A can be pulled out from our cloud-based payroll software with a single click of a button.

- Yearly PF Form 3A and 6A are available.

- Calculation of Employee & Employer part is done during salary processing.

- ESIC Sheet/ Summary can be prepared on our payroll management software.

- Automatic preparation of Excel template is offered for monthly filing.

- ESIC Challan can be prepared with ESIC Form 5 & 7.

- Option to define Professional Tax (PTAX) slabs is provided for different states.

- Automatic calculation of PTAX is provided according to the defined slabs.

- PTAX Challan can be prepared easily on our payroll management software.

- Returns for Professional Taxes can be easily prepared on our online payroll software.

- Automatic calculation of TDS is done based on investments.

- Declared/ made both types of investments can be managed easily.

- TDS Projections can be easily generated on our online payroll software.

- Quarterly Return (24Q) can be prepared on the payroll management software India.

- Yearly form 16 can be generated on our payroll management software.

Supplementary Payments

- $Any type of payment (Extra to monthly salary) can be managed with the help of supplementary payments.

- $Automatic calculation of payments is done on basis of Days & Month Basis.

- $Option on our Employee payroll management system is available to generate separate payslips for supplementary payments.

- $Quarterly Returns (24Q) can be prepared on our cloud based payroll software.

- $Yearly form 16 can be generated.

Full & Final Settlement

- $Full & Final Settlement can be managed on our payroll software in India for the left employees.

- $Full & Final Report can be generated with Employee History on our payroll management system.

- $An option is available to add / modify payments at the time of Full & Final Calculation.

- $Automatic Recovery of Pending Loan / Advances at the time of Full & Final Calculation.