Introduction to Fixed Asset Accounting

Welcome to the world of fixed asset accounting! If you’re new to this topic, you might be wondering what exactly fixed assets are and how they’re accounted for. Simply put, fixed assets are physical items that a company owns and uses in its business operations, such as buildings, machinery, and equipment. These assets are long-term in nature, meaning they are expected to be used for more than one year.

When it comes to accounting for fixed assets, it’s important to accurately track and record these assets in order to properly reflect a company’s financial position. This involves recording the acquisition cost, depreciation, and any disposals or disposals of the assets. Fixed asset accounting helps a business understand the value of its assets, which can be useful for tax purposes, financial planning, and decision-making.

Whether you’re a business owner or an accountant, understanding fixed asset accounting is crucial for the proper management and operation of a company. By staying organized and keeping track of these assets, you can ensure that your business is running smoothly and efficiently.

Table of Contents

What is Fixed Asset Accounting Software?

Fixed asset accounting software is a tool that helps businesses manage and track their fixed assets, such as buildings, equipment, and vehicles. These assets are typically high-value items that are integral to the operation of the business and are expected to be used over a long period of time.

Using fixed asset accounting software, businesses can track the acquisition, depreciation, and disposal of their fixed assets, as well as generate reports for financial and tax purposes. This helps businesses accurately account for the value of their assets and make informed decisions about their use and maintenance.

Fixed asset accounting software can be especially helpful for businesses with large numbers of fixed assets, as it allows them to easily track and manage these assets from a single platform. It can also be useful for businesses that need to maintain accurate records for compliance purposes, such as those in the healthcare or finance industries.

What are the Benefits of Fixed Asset Accounting Software?

Fixed asset accounting software offers a number of benefits to businesses, including:

- Accurate asset tracking: Fixed asset accounting software allows businesses to accurately track and record all of their fixed assets, including information about acquisition, depreciation, and disposal. This helps businesses ensure that their financial records are accurate and up-to-date.

- Efficient asset management: Fixed asset accounting software provides tools for businesses to efficiently manage their fixed assets, including features such as maintenance scheduling and inventory management. This helps businesses save time and resources by streamlining their asset management processes.

- Enhanced Compliance: Many industries, such as healthcare and finance, have strict compliance requirements when it comes to asset management. Fixed asset accounting software can help businesses stay compliant by providing the necessary tools and records to meet these requirements.

- Financial reporting: Fixed asset accounting software can generate reports on fixed asset values, depreciation, and disposals, which can be useful for financial planning and budgeting purposes.

- Increased productivity: By streamlining asset management processes and providing accurate and up-to-date records, fixed asset accounting software can help businesses increase their productivity and focus on other important tasks.

Overall, using fixed-asset accounting software can help businesses better track, manage, and optimize their assets, resulting in increased efficiency and improved financial performance.

Best Fixed Asset Accounting Software Tools

Welcome to our list of the 10 best fixed asset management software tools! As a business owner or manager, it’s important to keep track of your fixed assets, such as buildings, equipment, and vehicles. These assets can be valuable and integral to the operation of your business, but managing them can be a time-consuming and complex process.

That’s where fixed asset accounting software comes in. In this list, we’ll be showcasing some of the top fixed asset accounting software tools on the market, highlighting their key features and benefits. Whether you’re a small business owner or a large enterprise, there’s a fixed asset accounting software tool here that can help you streamline your asset management processes and stay on top of your financial records.

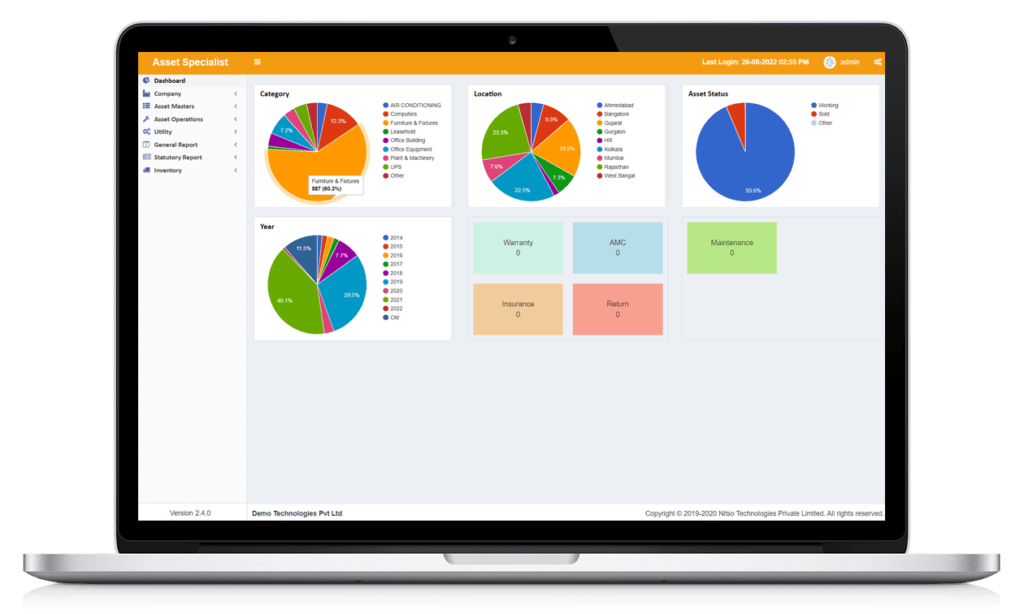

1. Nitso Fixed Asset Management Software

Nitso Fixed Asset Management Software is a comprehensive software solution designed specifically for businesses to manage and track their fixed assets. It allows businesses to keep track of all their fixed assets, including their purchase, depreciation, and disposal. The software also helps businesses to calculate the value of their fixed assets, which is essential for tax purposes and financial reporting.

Features:

- Easy asset tracking: Nitso Fixed Asset Accounting Software allows businesses to easily track and manage their fixed assets by creating asset records, assigning asset tags, and recording asset transactions.

- Depreciation calculation: The software can automatically calculate the depreciation of fixed assets based on the chosen depreciation method and schedule.

- Customizable reports: Nitso Fixed Asset Accounting Software allows businesses to generate custom reports for various purposes, such as tax reporting, financial reporting, and asset analysis.

- Security: The software has various security measures in place to ensure that all asset data is kept confidential and secure.

Pros:

- Automates asset management: Nitso Fixed Asset Accounting Software automates the entire process of asset management, which reduces the chances of errors and improves efficiency.

- Accurate asset valuation: The software calculates the value of fixed assets accurately, which is essential for tax and financial reporting purposes.

- Customizable: The software allows businesses to customize various aspects, such as the depreciation method and schedule, to suit their specific needs.

- User-friendly: The software is easy to use and navigate, making it suitable for businesses of all sizes.

Cons:

- Requires training: Some users may require training to effectively use all the features of the software.

- Upfront cost: The software requires an upfront cost, which may not be feasible for small businesses with limited budgets.

- Limited integration: Nitso Fixed Asset Accounting Software may not be easily integrated with other software solutions that a business may be using.

2. Zoho Inventory Management Software

Zoho Fixed Asset Accounting Software is a comprehensive solution designed to help businesses manage and track their fixed assets. It allows users to easily track and report on their fixed assets, such as computers, furniture, and equipment, through a simple and intuitive interface.

Features:

- Asset tracking: Easily track the location, condition, and value of your fixed assets.

- Depreciation calculations: Automatically calculate depreciation based on various methods, including straight-line, declining balance, and sum-of-years digits.

- Asset disposal: Keep track of assets that have been sold, scrapped, or donated, and generate reports on their disposal.

- Barcode scanning: Use barcodes to quickly and accurately track and update asset information.

- Mobile app: Access and update asset information on the go with the Zoho Inventory mobile app.

- Integration with accounting software: Easily import and export asset data to and from your accounting software.

Pros:

- Easy to use: Zoho Inventory has a user-friendly interface that makes it easy to track and manage fixed assets.

- Customizable: You can customize the software to fit your specific asset management needs.

- Cost-effective: Zoho Inventory is an affordable asset management solution for small and medium-sized businesses.

- Mobile app: The mobile app allows you to access and update asset information on the go.

Cons:

- Limited support: Zoho Inventory’s support team may not be as responsive as other asset management software providers.

- Limited features: Some users may find that the software lacks advanced features that larger businesses may need.

- Limited integration: The software may not integrate with certain accounting software programs.

3. Asset Panda is a fixed asset accounting software

Asset Panda Fixed Asset Accounting Software is a cloud-based platform that allows businesses to track, manage, and optimize their fixed assets. This includes items such as equipment, machinery, buildings, and vehicles. The software allows users to keep track of asset location, maintenance, depreciation, and insurance, as well as generate reports and alerts for asset management.

Features:

- Asset tracking: Asset Panda allows businesses to track the location, condition, and ownership of their assets in real time.

- Maintenance schedule: Users can schedule maintenance tasks and reminders for their assets to ensure they are in good working order.

- Depreciation calculation: Asset Panda calculates depreciation for each asset based on user-defined settings and accounting standards.

- Integration with accounting software: Asset Panda can be integrated with popular accounting software such as QuickBooks, Xero, and NetSuite.

- Customizable reporting: Users can generate custom reports on their assets and their performance.

- Mobile app: Asset Panda has a mobile app that allows users to access and update asset information on the go.

Pros:

- Easy asset tracking: Asset Panda makes it easy for businesses to track their assets and their performance, saving time and effort.

- Improved asset maintenance: Scheduling maintenance tasks and reminders helps businesses keep their assets in good working order, reducing downtime and increasing productivity.

- Accurate depreciation calculation: Asset Panda calculates depreciation accurately, ensuring businesses are in compliance with accounting standards.

- Flexible integration: Asset Panda can be integrated with popular accounting software, making it easy to manage assets and finances in one place.

- Customizable reporting: The ability to generate custom reports on assets helps businesses make informed decisions about their asset management.

- Mobile app: The mobile app allows users to access and update asset information on-the-go, improving efficiency.

Cons:

- Monthly subscription: Asset Panda is only available as a monthly subscription, which may not be suitable for businesses on a tight budget.

- Limited integration options: Asset Panda only integrates with a few popular accounting software, which may not be suitable for businesses using other software.

- Limited asset categories: Asset Panda only tracks a few asset categories, which may not be suitable for businesses with a wide range of assets.

4. Sage Fixed Asset Software

Sage Fixed Asset Accounting Software is a financial management tool specifically designed for tracking and managing fixed assets. It allows businesses to easily track asset purchases, depreciation, and disposals, as well as generate reports for tax and accounting purposes.

Features:

- Asset tracking: Allows businesses to keep track of all their fixed assets, including location, cost, and depreciation.

- Depreciation calculation: Automatically calculates depreciation for each asset based on user-defined rates and methods.

- Disposal tracking: Keeps track of when and how assets are disposed of, including any proceeds from the sale.

- Reporting: Generates various reports, including depreciation schedules, asset lists, and disposals, for tax and accounting purposes.

Pros:

- Simplifies asset tracking and management: With Sage Fixed Asset Accounting Software, businesses can easily track and manage all their fixed assets in one place, reducing the risk of errors and improving efficiency.

- Accurate depreciation calculation: The software automatically calculates depreciation for each asset based on user-defined rates and methods, ensuring accuracy and compliance with tax laws.

- Customizable reporting: The software allows businesses to generate various reports based on their specific needs, making it easy to track assets for tax and accounting purposes.

Cons:

- May have a steep learning curve for users unfamiliar with financial management software.

- May require additional training or support to fully utilize all the features.

5. Freshbooks Fixed Asset Accounting Software

Freshbooks Fixed Asset Accounting Software is a cloud-based accounting system specifically designed for businesses to manage and track their fixed assets. This includes tangible assets such as equipment, machinery, and vehicles that have long-term value and are used in business operations.

Features:

- Automated asset tracking: Allows businesses to easily track and update the status of their fixed assets, including location, depreciation, and maintenance.

- Customized asset categories: Allows businesses to create and organize their assets into specific categories to better track and manage them.

- Asset reports: Provides various reports on fixed assets, including depreciation schedules and asset listings.

- Integration with Freshbooks accounting software: Allows businesses to easily integrate their fixed asset accounting with their overall financial management.

Pros:

- Easy to use: Freshbooks Fixed Asset Accounting Software is user-friendly and intuitive, making it easy for businesses to manage their fixed assets.

- Cloud-based: Allows businesses to access and update their fixed asset information from anywhere with an internet connection.

- Customization options: Businesses can customize the software to fit their specific needs and asset tracking requirements.

Cons:

- Limited asset tracking options: The software may not have all the features and capabilities that businesses with extensive fixed asset needs may require.

- Dependence on internet connection: Since the software is cloud-based, businesses may not be able to access it if they have limited or no internet connection.

6. ManagerPlus Cloud Asset Management Software

ManagerPlus Cloud Fixed Asset Accounting Software is a cloud-based asset management solution designed for businesses to track, maintain, and report on their fixed assets. The software allows users to easily store and access asset data, including purchase information, location, and maintenance records.

Features:

- Asset tracking: Users can easily track the location and status of their assets, including whether they are in use, in storage, or being serviced.

- Maintenance management: Users can schedule and track maintenance tasks, including setting up alerts for upcoming maintenance due dates.

- Reporting: The software provides a range of customizable reports, including asset depreciation, asset value, and asset inventory reports.

- Integration: ManagerPlus Cloud Fixed Asset Accounting Software can integrate with other business systems, including accounting software and enterprise resource planning (ERP) systems.

Pros:

- Cloud-based: The software can be accessed from any device with an internet connection, making it convenient for businesses with remote or mobile employees.

- User-friendly interface: The software is easy to use, with a simple interface and clear instructions for tasks.

- Customizable: Users can customize the software to meet their specific needs, including setting up custom fields and reports.

- Scalable: The software can be scaled up as a business grows, allowing users to add new assets and users as needed.

Cons:

- Dependent on internet connection: Because the software is cloud-based, users will need a stable internet connection to access the software.

- Initial setup may be time-consuming: Setting up the software and entering asset data may take some time, depending on the size of the business and the number of assets being tracked.

- Ongoing maintenance: Users will need to keep their asset data up to date, including adding new assets and maintaining maintenance records.

7. Xero Fixed Asset Accounting Software

Xero Fixed Asset Accounting Software is a comprehensive tool designed to help businesses manage and track their fixed assets. It provides a central repository for all fixed asset information, including asset descriptions, location, and depreciation schedules.

Features:

- Asset register: Allows users to track and manage fixed assets, including serial numbers, asset descriptions, and location.

- Depreciation: Automatically calculates depreciation based on the asset’s useful life and provides reports on depreciation schedules.

- Purchase and disposal: Allow users to track and record asset purchases and disposals, including sale price and date.

- Barcode scanning: Allows users to quickly and easily scan assets using a barcode scanner.

- Custom fields: Allows users to add custom fields to asset records, such as asset type or condition.

Pros:

- Provides a central repository for all fixed asset information, making it easy to access and manage.

- Automatically calculates depreciation, saving time and eliminating the risk of errors.

- Allows users to track asset purchases and disposals, providing a complete record of asset movement.

- Custom fields allow users to track additional information about their assets.

Cons:

- May require a learning curve for users who are unfamiliar with fixed asset accounting software.

- Some users may find the interface confusing or difficult to navigate.

- The cost of the software may be prohibitive for some businesses.

8. Deltek Asset Software

Deltek Fixed Asset Accounting Software is a financial management solution designed specifically for government contractors and organizations with complex asset management needs. It offers a range of features to help businesses accurately track, manage, and maintain their fixed assets, including property, plant, and equipment.

Features:

- Asset tracking and management

- Capitalization and depreciation tracking

- Integration with other Costpoint modules, such as procurement and project management

- Custom asset fields and tags for easy organization and searching

- User-defined asset categories and locations

- Barcode scanning for efficient data entry

- Generates asset reports and tax schedules

Pros:

- Allows for easy tracking and management of fixed assets

- Integrates with other Costpoint modules for a seamless financial management system

- Customization options for asset categorization and tracking

- Streamlines asset reporting and tax schedules

Cons:

- May be a more expensive option compared to other asset management software

- Requires a subscription and ongoing maintenance fees

- May have a steep learning curve for those unfamiliar with Costpoint or asset management software in general.

9. TallyPrime Fixed Asset

TallyPrime Fixed Asset is a comprehensive and powerful tool for managing and tracking your company’s fixed assets. It allows you to easily record and track the acquisition, depreciation, and disposal of fixed assets, as well as generate reports and analyze asset data.

Features:

- Comprehensive asset management: TallyPrime Fixed Asset provides complete tracking and management of fixed assets, including acquisition, depreciation, and disposal.

- Asset categorization: You can easily categorize your assets by type, location, or other criteria to better manage and track them.

- Customizable asset fields: The software allows you to customize asset fields to fit your specific needs, such as adding custom tags or notes to an asset.

- Reporting and analysis: TallyPrime Fixed Asset generates a variety of reports, including balance sheets, depreciation schedules, and asset summaries, which can be analyzed to identify trends and make informed business decisions.

Pros:

- Streamlines asset management: The software makes it easy to keep track of all your assets in one place, reducing the risk of errors and improving efficiency.

- Customizable: The ability to customize asset fields allows you to tailor the software to fit your specific needs.

- Comprehensive reports and analysis: The software generates a variety of reports that can be analyzed to help you make informed business decisions.

Cons:

- Requires data entry: TallyPrime Fixed Asset Accounting Software relies on manual data entry, which can be time-consuming and prone to errors.

- May be expensive: The software may be cost-prohibitive for some small businesses.

- Limited integration: The software may not integrate with other business systems, making it difficult to share data across departments.

10. UpKeep Fixed Asset Accounting Software

UpKeep Fixed Asset Accounting Software is a cloud-based asset management solution that helps businesses track, manage, and maintain their fixed assets. This software allows users to easily capture and store data on their assets, including serial numbers, locations, and maintenance records. It also allows users to create custom tags and categories for better organization of their assets.

Features:

- Asset tracking: UpKeep Fixed Asset Accounting Software allows users to track the location and status of their assets in real-time.

- Maintenance management: This software allows users to schedule and track maintenance for their assets, ensuring that they are kept in good working condition.

- Custom tags and categories: Users can create custom tags and categories to better organize and manage their assets.

- Reporting: UpKeep Fixed Asset Accounting Software provides detailed reports on asset performance and maintenance, allowing users to make informed decisions about their assets.

Pros:

- User-friendly interface: The software is easy to use and navigate, making it accessible to users of all skill levels.

- Cloud-based: UpKeep Fixed Asset Accounting Software is cloud-based, meaning that users can access it from anywhere with an internet connection.

- Customizable: Users can customize the software to fit their specific asset management needs.

Cons:

- Limited integrations: UpKeep Fixed Asset Accounting Software only integrates with a few other business tools, limiting its functionality.

- Limited support: The software only offers limited support options, such as email and chat support.

- Cost: UpKeep Fixed Asset Accounting Software can be expensive for small businesses with limited budgets.

How To Choose The Right Asset Tracking Software?

Choosing the right asset-tracking software can be a daunting task, as there are many different options available and it is important to select a solution that meets the specific needs of your business. Here are some key considerations to keep in mind when evaluating asset-tracking software:

-

Compatibility with your current systems:

Make sure the asset tracking software you choose is compatible with your current business systems, such as your accounting or enterprise resource planning (ERP) software.

-

Ease of use:

Look for asset-tracking software that is user-friendly and easy to navigate, as this will make it easier for your team to adopt and use the software on a regular basis.

-

Scalability:

Consider the size and growth potential of your business when choosing asset-tracking software. You may want to select a solution that can scale with your business as it grows and evolves.

-

Customization:

Look for an asset tracking software that allows for customization to fit the specific needs and processes of your business.

-

Support and training:

Choose an asset-tracking software that offers good customer support and training resources to help you get the most out of the software.

-

Price:

Consider the cost of the asset tracking software, including any additional fees for features or support. Make sure it fits within your budget and provides good value for money.

By considering these factors, you can select an asset-tracking software that meets the specific needs of your business and helps you streamline and optimize your asset management processes.

Common Challenges of Implementing an Asset Tracking System

Implementing a fixed asset management system can bring many benefits to a business, but it can also present some challenges. Some common challenges of implementing an asset tracking system include:

- Cost: Asset tracking systems can be expensive to purchase and implement, particularly for businesses with a large number of assets. This can be a significant barrier for some businesses, especially smaller ones.

- Complexity: Asset tracking systems can be complex to set up and use, particularly for businesses that are new to this type of technology. This can be a daunting task for some business owners and employees, who may need to invest time and effort in learning how to use the system.

- Integration: Asset tracking systems may need to be integrated with other business systems, such as financial and HR software. This can be a complex process that requires technical expertise and can be time-consuming.

- User adoption: Some employees may resist using a new asset tracking system, especially if they are used to traditional methods of tracking assets. It may take time for employees to become comfortable with using the new system, which can impact its overall effectiveness.

- Data accuracy: Asset tracking systems rely on accurate and up-to-date data to be effective. If the data entered into the system is not accurate, it can impact the accuracy and usefulness of the system as a whole.

Despite these challenges, implementing an asset-tracking system can bring significant benefits to a business in terms of improved asset management and increased efficiency. With careful planning and consideration, these challenges can be overcome and the benefits of the system can be realized.

Conclusion

In conclusion, fixed asset accounting software is a valuable tool for businesses looking to streamline their asset management processes and increase productivity. The 10 best-fixed asset accounting software options listed in this article offer a range of features and capabilities to suit the needs of different businesses. By using fixed asset accounting software, businesses can easily track, manage, and optimize their fixed assets, saving time and ensuring accurate asset tracking and management. Whether you are a small business owner or a large corporation, there is fixed asset accounting software that can help your business achieve maximum productivity.

0 Comments