A payroll report is a summary of the compensation paid to employees over a set period. Payroll reports are an essential part of running a business as they break down how much each employee earned in gross wages along with all taxes, deductions, and withholdings.

For most businesses, generating payroll reports regularly is crucial for tracking labour costs, performing financial analysis, budgeting, and ensuring compliance with payroll tax laws. While many companies rely on payroll software to produce reports, creating customized Excel templates provides more flexibility and customization in reporting.

With a payroll report template, businesses can reuse the same structured format each time a report needs to be generated rather than building from scratch. Templates allow for efficient reporting and the ability to spot trends over time. Common periods for payroll reports include weekly, biweekly, monthly, quarterly, and annually.

Standard payroll reports summarize data such as employee names, departments, job titles, salary/wage rates, hours worked, earnings amounts, tax withholdings, deductions, reimbursements, paid time off taken, and net pay. Companies can choose to report on a few employees, a department, or organization-wide. Read on to see how you can optimize and simplify payroll reporting for your business using payroll report templates.

Table of Contents

Benefits of Using Payroll Report Templates

Payroll reporting is crucial yet often complex for businesses. While payroll software provides reporting, manually creating customized Excel templates can also aid efficiency and analysis. There are several important benefits for businesses that create and rely on payroll report templates:

- Save time – Once the template is set up, it can be reused each pay period which is faster than formatting a new report from scratch each time. Information just needs to be updated.

- Consistent format – The data and calculations are presented consistently in each report which allows for easy analysis of trends over time.

- Error checking – Formulas built into the template perform calculations and can identify discrepancies for review.

- Customization – Templates allow businesses to add or remove categories of information as needed. They can also be formatted to focus on specific departments, locations, or employee groups.

- Compliance – Payroll reports contain information needed to comply with reporting requirements for taxes, insurance, annual wages, etc.

- Data analysis – Formats like charts and graphs can be added to visualize payroll data and find patterns.

Having customizable payroll templates makes the reporting process much more efficient while providing the business intelligence needed for sound decision-making.

Types of Payroll Reports

Payroll reports can be generated weekly, bi-weekly, monthly, quarterly, or annually. The time span covered influences the purpose and level of detail. In this section, we’ll take a look at the most common reporting frequencies and what they are best used for:

Weekly Payroll Reports

- Cover a 1-week period.

- Used to calculate weekly payroll for hourly employees.

- Helpful for tracking over time.

- Not as common for salaried employees.

Monthly Payroll Reports

- Cover a 1-calendar month period.

- Used to have a longer-term view of payroll expenses.

- Helpful for monthly budgeting needs.

- Commonly used in addition to weekly reports.

Quarterly Payroll Reports

- Cover a 3-month period.

- Provide a big-picture overview of labour costs and trends.

- Used for quarterly tax reporting needs.

- Track bonuses paid out by quarter.

Annual Payroll Reports

- Cover full calendar or fiscal year.

- Summarize total annual payroll expenses for the company.

- Essential for meeting year-end tax filing requirements.

- Useful for annual budgeting and long-term trend analysis.

The frequency of the payroll report depends on the specific needs of each business. Many generate weekly or biweekly for short-term tracking as well as quarterly and yearly payroll report templates for bigger-picture analysis.

7 Essential Elements of Payroll Report Templates

A good payroll report template will contain certain key elements:

- Employee details – This should include full name, employee ID number, job title, department, location, and pay rate.

- Earnings – All income categories should be listed such as regular wages, overtime wages, bonuses, commissions, reimbursements, allowance, tips, etc.

- Deductions – Taxes and voluntary deductions should be included such as federal, state and local taxes, health insurance premiums, 401k contributions, charitable donations, etc.

- Paid time off – Categories like vacation, sick time, holidays, etc. should be tracked.

- Net pay – After taking all deductions into account, the final net pay amounts should be calculated.

- Company totals – Totals should be provided for total payroll cost, total taxes paid, total deductions, etc. for the company.

- Time period – The exact dates the report covers should be indicated.

A standardized template that includes these components provides consistency and ensures all key information is captured in each report. Additional elements can be added as needed for specific business requirements or customizations. The level of detail may also vary based on whether the report is for a single department or an entire company.

Steps to Create the Payroll Report Template

Like an artist visualising their masterpiece before picking up a paintbrush, creating a payroll report template takes planning, foresight and creative vision. The key steps involved in creating a payroll report template in Excel are:

- Determine the reporting period – Decide if you need a weekly, bi-weekly, monthly, quarterly, or yearly payroll report template. This will impact the data you need to include.

- Identify required data fields – Based on reporting needs, list out all payroll data to include such as employee details, earnings, deductions, reimbursements, time off, taxes, net pay, etc.

- Create column headings – Turn the data fields into clear column headings so anyone can understand the template. Label the columns clearly.

- Set up employee rows – Add rows for each employee that needs to be included in the template. Fill in static details like name, ID, and department.

- Add formulas – Use Excel formulas like SUM, IF statements, and VLOOKUPS to calculate totals, taxes, deductions and net pay.

- Format cells and fonts – Make sure currency, percentages, and dates are formatted properly. Good font sizes also help readability.

- Add visual elements – Charts, graphs, borders, colouring, etc can make the reports more visually appealing.

- Triple check accuracy – Verify all formulas are error-free and pull numbers properly before finalizing the template.

- Save template – Save the template so it can be reused for generating each payroll report. Update employee data each time.

Steps to Fill Out a Payroll Report Template

Once payroll report templates are set up, they need to be filled out consistently and accurately each period. This section outlines the steps involved in filling, verifying, and finalizing templates with new payroll data. Following a clear methodology ensures completeness while avoiding errors. Here are typical steps:

- Enter New Employee Data – Any new employees who have been added in the pay period need to be entered into the template. Fill in their name, ID, job title, department, pay rate and any other required details.

- Update Payroll Amounts from Recent Pay Period – Pull the payroll data from your payroll system for the new pay period. Update the earnings, deductions, paid time off, and net pay figures for each employee in the template. All totals will calculate automatically.

- Verify Accuracy – Double-check that all formulas are calculating correctly and no data entry errors exist. Pay special attention to payroll amounts that do not look normal compared to past reports.

- Finalize Report – Make any necessary adjustments and ensure all data is accurate before finalizing the report. Format it appropriately for professional presentation.

- Save Completed Report – Save the final report with the pay period dates or relevant titles so past versions can be accessed. This completed report now contains the payroll snapshot for that time period.

- Prepare for Next Payroll Period – Delete any employee records that are no longer needed going forward. The template will then be ready for the next round of data for the upcoming pay period.

Sample Payroll Report Templates

When creating a payroll report template, it can be helpful to see examples of what these templates look like and the type of information they contain.

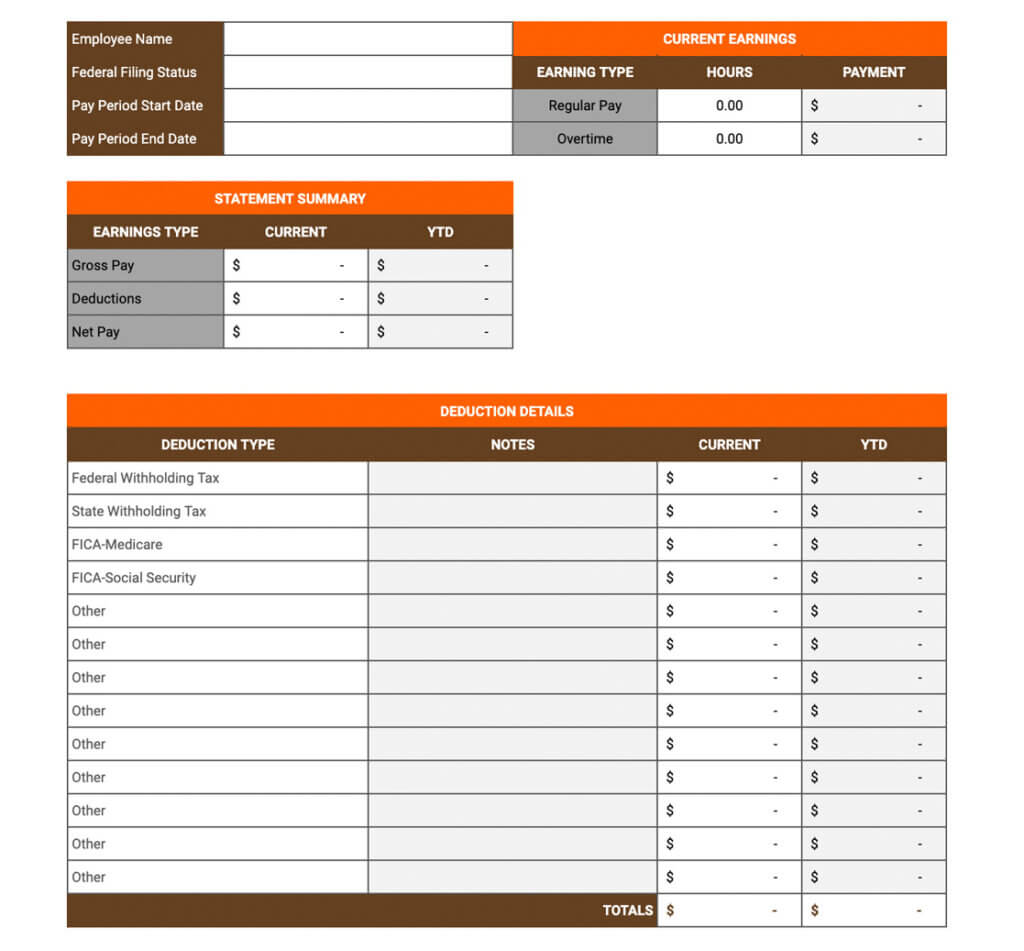

Single Employee Payroll Report Template

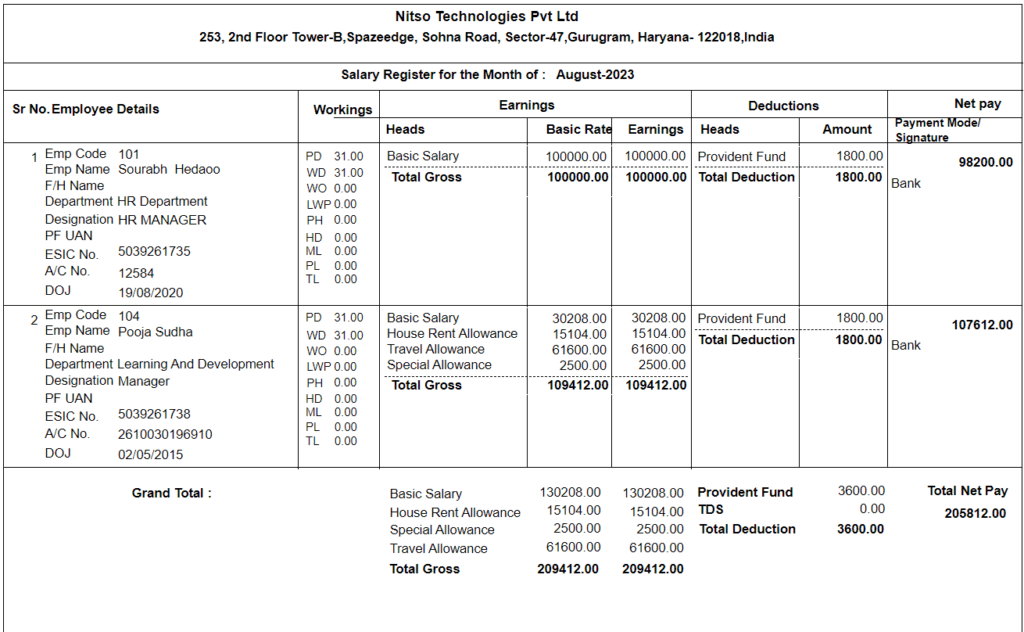

Monthly Payroll Report Template

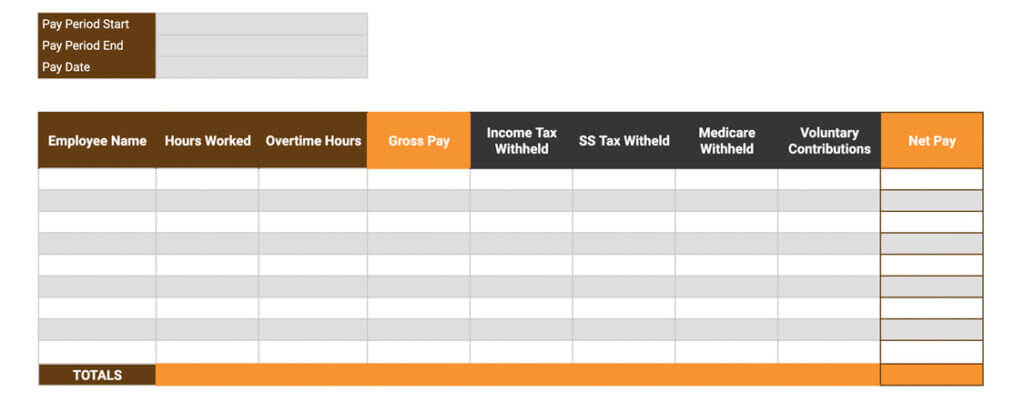

Annual Payroll Report Template

These are just a few examples of how payroll report templates can be structured and customized to meet different needs. Screenshots of sample templates can be very helpful.

Tips for Customizing the Payroll Report Template

This section reveals expert tips to tailor-make reports that satisfy your business needs. Tips for Customizing the Payroll Report Template are:

- Allow filtering and sorting – Use Excel’s filter and sorting functionality for easy analysis of report data.

- Add conditional formatting – Use colour scales, icon sets, or data bars to highlight specific values like top earners, overtime hours, etc.

- Include summary metrics – Add columns with averages, minimums, maximums, and percentages for key data points.

- Use multiple tabs – Separate data into multiple tabs by department, location, or time period for easy comparison.

- Link charts and graphs – Insert charts that update dynamically based on the template figures.

- Add comment fields – Include comment boxes for clarifications, assumptions, or limitations of the report.

- Make future projections – Use formulas or extra columns to project future payroll costs based on historical trends.

- Protect key data – Lock certain critical columns that shouldn’t change or require password access.

- Notes and instructions – Provide notes on how the template gets updated each period or for reviewing unusual data.

- Customize for user needs – Talk to stakeholders about specific data analysis needs and customize accordingly.

The flexibility of Excel allows many possibilities for enhancing payroll templates. Focus on improvements that add the most value for management and decision-making needs.

Article you might be intrested in: The Importance of Confidentiality and Data Security in Payroll Management

Managing Payroll Report Templates

They say the key to comedy is timing. The same holds true for managing payroll templates over time. Once payroll report templates have been created, proper management of the templates is important for maintaining accuracy and security:

- Store templates in a secure location – Keep template files in a protected folder accessible only by authorized payroll staff. Don’t store on individual computers.

- Restrict edit access – Consider protecting cells to limit who can edit the template structure vs just inputting data.

- Backup copies – Save copies of old report versions and have a backup process for templates in case of data loss.

- Review for updates – Periodically review templates to see if any changes are needed based on adjustments to payroll processes.

- Track versions – Save reports with version numbers or dates so you know the template version used for each report.

- Watch for errors – Investigate any formulas not calculating as expected to identify the root cause.

- Audit reports – Do periodic audits by double-checking report calculations against the payroll system.

- Documentation – Keep documentation on how the templates should be completed and saved each pay period.

- Access controls – Only authorized payroll administrators should fill out and edit finalized reports.

Proper template management ensures payroll reports remain accurate over time. It also provides process consistency across payroll staff using the templates.

Article you might be intrested in: Everything Employees and Employers Need to Know About Back Pay

How to File Annual Payroll Reports with the Indian Government

In India, businesses are required to file annual payroll reports with the government. Here are some key considerations:

- Due Dates – The due date for filing annual payroll returns is by April 30th following the end of the fiscal year on March 31st. Extensions may be requested.

- Forms – The main form is the Annual Return under Section 92E which provides TFHA (Tax Deduction and Collection Account Number) wise breakup of salaries paid and taxes deducted.

- Form 24Q – This form reports TDS (Tax Deducted at Source) on salaries quarterly. An annual reconciliation is required.

- Form 16 – This certificate provides employee-wise TDS details. It must be issued to employees by mid-June.

- E-filing – Annual payroll forms must be e-filed through the government’s TRACES portal. Physical documents are no longer accepted.

- Penalties – Late filing can result in penalties of Rs 200 per day. Incorrect reporting can also incur fines.

Keeping accurate payroll records and report templates allows businesses to efficiently meet annual filing requirements. Adhering to due dates also avoids penalties.

The Finish Line: Get More Out of Payroll Reports with Nitso HRMS

Creating efficient payroll report templates takes effort but pays rewards through enhanced consistency, accuracy, and analysis. While generic payroll software offers reporting, developing customized templates aligned to your business needs provides more meaningful insights.

This article outlined best practices for building templates tailored to different reporting requirements and frequencies. With the right templates, payroll reporting becomes an impactful tool, not a burdensome task.

Businesses looking for an all-in-one solution for payroll management and reporting should explore Nitso HR Software. This robust platform offers integrated payroll software with customizable templates for weekly, monthly, quarterly and annual reporting.

Nitso HRMS provides pre-built templates that can be easily configured to your specifications. Templates allow filtering, formatting, and custom fields for added analytics. Secure role-based access ensures appropriate access controls.

Say goodbye to manual spreadsheet templates and inflexible software reports. Nitso HRMS combines integrated payroll, HR, and template-driven reporting for simplified processes and better business intelligence. Sign up for a free demo today to see how Nitso HRMS can optimize your payroll reporting.

FAQs Related to Payroll Report Template

What is a payroll report template?

A payroll report template is a reusable structure for presenting payroll data like earnings, taxes, deductions, and net pay for employees over a set time period. Templates allow efficient payroll reporting each period.

Is there a payroll template in Excel?

Yes, Excel is commonly used to create customizable payroll report templates. Excel provides flexibility in formatting, calculations, visualizations, and customization.

How to create payroll report template in Excel or PDF?

The key steps are: list required fields, add columns/rows, use formulas for calculations, format cells, colours, and fonts, add charts, double-check accuracy, and save as a template.

What is the format of payroll report template?

Common formats are Excel (XLSX), PDF, or Word docs. Excel provides the most customization flexibility. PDF templates are better for distributing printed reports.

What is payroll in HR information?

Payroll is the process of paying employees and reporting, withholding, and filing taxes on compensation. Payroll data is essential HR information for managing the workforce.

What is payroll and example?

Payroll involves paying employee salaries and wages along with taxes, deductions, and net pay. An example is a biweekly payroll report with earnings, deductions, and direct deposit info.

Is Excel payroll free?

Excel by itself does not handle payroll processing but is just a spreadsheet tool. However, templates for payroll reporting in Excel can be created for free without any additional payroll software.

How do I view payroll reports?

Log into the payroll system and navigate to the reports section. Filter report parameters or select a template to view payroll data summary for a recent period.

0 Comments