On Wednesday (01-Feb-2023), Union Finance Minister Nirmala Sitharaman presented the Union Budget 2023, marking the fifth budget presentation under the Modi government. As the final full-fledged budget before the upcoming general elections, Sitharaman expressed confidence in the future of the Indian economy, asserting that it is on the right path toward sustained growth.

Sitharaman announced significant changes to the income tax slabs under the new tax regime in a major move aimed at boosting both the taxpayer and the economy. She also revealed a significant increase in the railway sector’s allocation and capital expenditure. These initiatives are expected to boost the economy, helping drive growth and increase opportunities for businesses and individuals alike.

The budget 2023 presented by Sitharaman represents a significant moment for the Indian economy, as it seeks to build upon the progress made over the past few years and chart a path toward a brighter future. With a focus on economic growth and job creation, the budget lays a clear roadmap for the Indian economy. It is expected to be well-received by businesses, taxpayers, and citizens alike.

Table of Contents

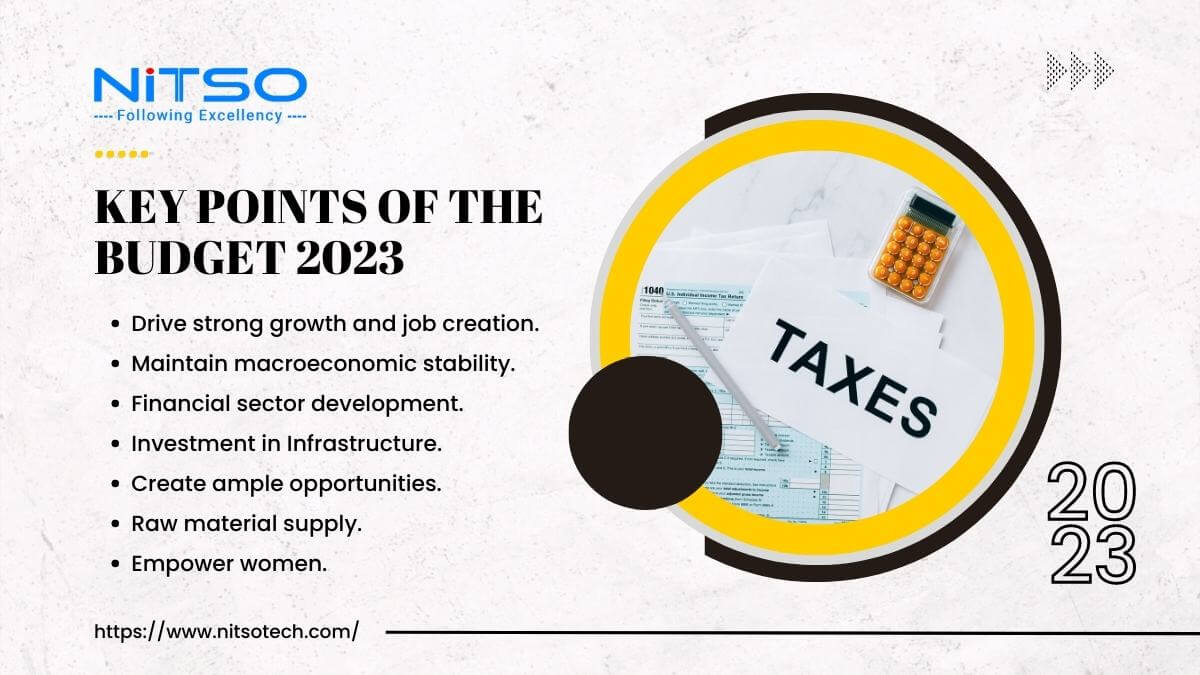

The objectives of Budget 2023 are to

- Create ample opportunities for citizens, particularly the youth.

- Drive strong growth and job creation.

- Maintain macroeconomic stability.

- Empower women in the Budget 2023.

- Enable women’s self-help groups to advance their economic empowerment.

- Assist self-help groups with raw material supply, branding, and product marketing.

What Gets Cheaper and What Gets Costlier

Got Cheaper

- Mobile phones

- Televisions

- Lab-grown diamonds

- Shrimp feed

- Machinery for lithium-ion batteries

- Raw materials for the electric vehicle industry

Got Costlier

- Cigarettes

- Silver

- Compounded rubber

- Imitation jewellery

- Articles made from gold bars

- Imported bicycles and toys

- Imported kitchen electric chimneys

- Imported luxury cars and electric vehicles.

Visit if you would like to know more about Things Getting Costlier and Cheaper.

Overview of the 2023 Budget’s Key Features

Presenting the most significant elements of the measures announced by Finance Minister Sitharaman in Budget 2023, here is a sector-wise analysis:

Income Tax Payers

- No changes in the old tax regime.

- The new tax regime becomes the default option, but citizens can choose the old regime.

- No tax on income up to Rs 7.5 lakh a year under the new tax regime (with standard deduction included).

- The government proposes reducing the highest surcharge rate from 37% to 25% in the new tax regime.

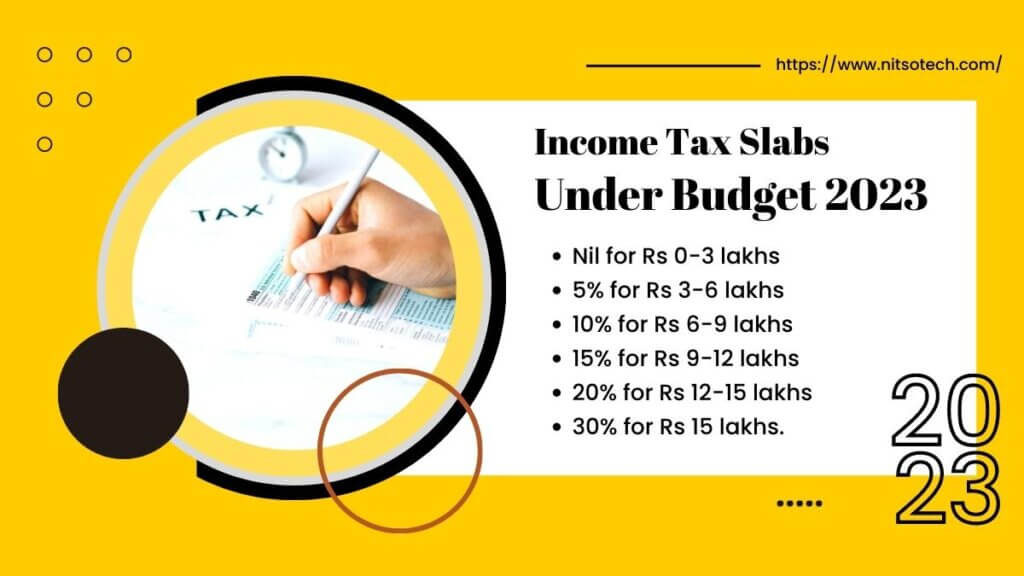

Income Tax Slabs Under the New Tax Regime

- Nil for an annual income of Rs 0-3 lakhs

- 5% for an annual income of Rs 3-6 lakhs

- 10% for an annual income of Rs 6-9 lakhs

- 15% for an annual income of Rs 9-12 lakhs

- 20% for an annual income of Rs 12-15 lakhs

- 30% for an annual income over Rs 15 lakhs.

Measures Announced for Income Tax Payers

- An individual with an annual income of Rs 9 lakh will pay only Rs 45,000 in taxes, according to FM Sitharaman.

- An income of Rs 15 lakh will incur a tax of Rs 1.5 lakh, down from Rs 1.87 lakh.

- The new regime introduced a standard deduction of Rs 50,000 for taxpayers.

- Payment received from the Agniveer Corpus Fund by Agniveers will be exempt.

- Tax exemption removed for insurance policies with a premium over Rs 5 lakh.

- The government proposes to provide for TDS and taxability on net winnings from online games at the time of withdrawal or the end of the fiscal year.

- Tax exemption on leave encashment on retirement for non-government salaried employees has been raised to Rs 25 lakh from Rs 3 lakh.

- A higher limit of Rs 3 crore for TDS on cash withdrawal has been set for cooperative societies.

- The next-generation Common IT Return Form will be introduced for the convenience of taxpayers.

- The grievance redressal mechanism will be strengthened.

- The TDS rate will be reduced from 30% to 20% on the taxable portion of EPF withdrawal in non-PAN cases.

Indirect Taxes

- A 16% increase in taxes on selected cigarette brands

- Lower tax rate of 15% for new cooperatives that start manufacturing before March 2024

- Reduction of primary customs duty on crude and glycerine to 2.5%.

- Hike in import duty on silver bars to align with gold and platinum.

- Extension of customs duty cut on imports of mobile phone parts for one year

- Reduced customs duty on open cells of TV panels to encourage TV manufacturing

- Relief on customs duty on import of specific parts and inputs such as camera lens

- Concessionary duty on lithium-ion cells for batteries extended for another year

- Reduction of basic customs duty rates on goods other than textiles and agriculture from 21 to 13, resulting in minor changes in taxes on items such as toys, bicycles, and automobiles.

Savings Scheme Enhancements

- The maximum deposit limit for the Senior Citizen Savings Scheme has been increased to Rs 30 lakh, up from the previous limit of Rs 15 lakh.

- The Monthly Income Scheme limit has been doubled to Rs 9 lakh for individual accounts and Rs 15 lakh for joint accounts.

- A new saving scheme, the Mahila Samman Saving Certificate, has been introduced for a period of 2 years up to March 2025, exclusively for women.

- This certificate offers a deposit facility of up to Rs 2 lakh in the name of women or girls with a fixed interest rate of 7.5% and the option for partial withdrawal. Visit to know more about Savings Scheme for Women in budget 2023.

Increased Capital Expenditure by 33%

- A 33% hike in capital investment, amounting to Rs 10 lakh crore, has been announced for the third year to boost growth, create jobs, attract private investments, and mitigate global challenges.

- The actual capital expenditure of the center is estimated to be Rs 13.7 lakh crore.

- The capital outlay will be 3.3% of GDP in the fiscal year 2024.

- The center’s effective capital expenditure for the fiscal year 2024 is estimated to be Rs 13.7 lakh.

- A new Infrastructure Finance Secretariat has been established to provide opportunities for private investment in infrastructure.

Revamped Support for MSMEs

- The credit guarantee scheme for MSMEs will be updated on April 1, 2023, with an injection of Rs 9,000 crore into the corpus.

- This revised scheme will provide MSMEs with an additional Rs 2 lakh crore in collateral-free guaranteed credit and lower the cost of credit by approximately 1%.

Banking Reforms

- The government proposes changes to the Banking Regulation Act to enhance governance within banks.

Jobs

- The government announces the launch of Pradhan Mantri Kaushal Vikas Yojana 4.0

- To equip the youth with the necessary skills for international opportunities, 30 Skill India International Centers will be established in various states.

- A pan-India National Apprenticeship Promotion Scheme will be introduced, providing a direct benefit transfer stipend to support 47 lakh young individuals over the course of three years.

Clean Energy Initiatives

- An allocation of Rs 35,000 crores for the clean energy transition

- Introduction of the Green Credit Program under the Environment Protection Act

- Battery storage projects to receive Viability Gap Funding support\

- Government to support the establishment of 4,000 MWh of battery energy storage.

- Launch of the National Green Hydrogen Mission with a budget of Rs 19,700 crore to reduce carbon intensity, decrease dependency on fossil fuels, and establish technology and market leadership in the country.

Gems and Jewellery

- The government will provide a five-year research and development grant to one of the Indian Institutes of Technology (IITs) to boost the local production of lab-grown diamonds.

- A proposal to reassess the customs duty on lab-grown diamonds will be included in the Part-B section of the budget 2023 document.

Streamlining Business Procedures

- The government is introducing the Vivad Se Vishwas-2 scheme to resolve commercial disputes.

- PAN will serve as a universal identification for all digital systems used by government agencies

- A single source for reconciliation and updating of identity information from various agencies through Digi Locker and Aadhaar

- A Central Processing Center will be established to expedite the processing of forms filed under the Companies Act.

- For business entities required to have a Permanent Account Number, the PAN will serve as a universal identifier for specified government agency digital systems.

- Over 39,000 compliances have been streamlined, and more than 3,400 legal provisions have been decriminalized to improve the ease of business.

- The Jan Vishwas Bill has been introduced to amend 42 Central Acts and foster trust-based governance.

- The Finance Minister announces various measures to boost business activity in GIFT City.

Expanded Digital Offerings

- The capabilities of DigiLocker will be broadened.

- One hundred research and development centers will be established in universities to design applications for 5G technology.

- These labs will focus on innovation in areas such as smart classrooms, precision agriculture, and healthcare.

- The third phase of the E-courts project, with a budget of Rs 7,000 crore in 2023, will be initiated.

- Major players in the industry will team up to provide scalable solutions for health, agriculture, and other industries.

Health Sector Boosted in Budget 2023

- The Union Budget 2023 has allocated a total of Rs 89,155 crore for the health sector.

- Aiming to eliminate sickle cell anemia by 2047

- A new pharmaceutical research program will be introduced to encourage investment from the industry.

- Out of the total allocation, Rs 86,175 crore has been assigned to the Department of Health and Family Welfare and Rs 2,980 crore to the Department of Health Research.

- The budget allocation for the Pradhan Mantri Swasthya Suraksha Yojana for 2023-2024 is set at Rs 3,365 crore.

- The National Health Mission’s allocation has increased from Rs 28,974.29 crore.

- The AYUSH ministry’s allocation has increased from Rs 2,845.75 crore.

- The National Digital Health Mission (NHM) allocation has increased from Rs 140 crore to Rs 341.02 crore.

- The allocation for the National Tele Mental Health Programme has increased from Rs 121 crore to Rs 133.73 crore.

- The allocation for autonomous bodies has risen from Rs 10,348.17 crore in 2022-23 to Rs 17,322.55 crore in 2023-24

- The allocation for the Indian Council of Medical Research (ICMR) has increased from Rs 2,116.73 crore to Rs 2,359.58 crore.

Housing in Budget 2023

- The budget allocation for the Prime Minister’s Housing Scheme has been increased by 66% to over Rs 79,000 crore.

Interest-free loan to states to continue

- The government will extend the 50-year interest-free loan program to state governments for an additional year.

Education

- Establishment of three centers of excellence in top educational institutions for AI.

- 157 new nursing colleges will be established in conjunction with 157 medical colleges established since 2014.

- Eklavaya Model Residential Schools will be created in the next three years with 38,800 teachers and staff to serve 3.5 lakh tribal students.

- Introduction of the National Data Governance Policy to spur innovation and research by startups and academia.

- There was a 9.37% increase in grant allocation for the University Grants Commission (UGC).

- 17.66% increase in funding for central universities, 27% increase for deemed universities, 14% increase for IITs, and 10.5% increase for NITs compared to the previous fiscal year.

The Seven Key Priorities of the Budget 2023, ‘Saptarishi’

- Comprehensive Development

- Bridging the Gap

- Investment in Infrastructure

- Unleashing Potential

- Environmental Sustainability

- Empowering Youth

- Financial Sector Development.

Related articles:

- Budget 2020 Explained For Salaried Employees

- HCM Implementation in your business: Why essential in 2023

- HRA exemption (House Rent Allowance) in India

Conclusion

The Union Budget 2023 has a comprehensive approach to drive the country’s economic growth and empower citizens, particularly the youth and women. The budget 2023 has allocated funds to various sectors, such as education, health, housing, and digital services, to ensure inclusive development and reach the last mile. The budget aims to provide ample opportunities for citizens, facilitate growth and job creation, strengthen macroeconomic stability, and empower women through various initiatives. By supporting self-help groups with raw material supply, branding, and marketing of products, the budget 2023 aims to enable women to reach the next stage of economic empowerment.

0 Comments