The Income Tax Slabs in India are updated annually by the finance minister. There are currently two options for taxpayers: the new and the old tax regimes. Both offer tax benefits.

Finance minister Nirmala Sitharaman introduced changes to the current income tax slabs in the 2023 Union Budget on February 1.

The new tax regime now offers a higher rebate, increasing from Rs. 5 lahks to Rs. 7 lahks, meaning taxpayers with taxable income below Rs. 7 lakhs will not have to pay any tax. Additionally, the tax slab for the new regime has been altered. The surcharge rate for income above Rs. 5 crores has been reduced from 37% to 25%. Furthermore, the standard deduction of Rs. 50,000 has been extended to the new tax regime.

Note: Filing taxes just got easier with the introduction of the New Income Tax Portal. This platform offers many features designed to streamline your tax filing process.

Table of Contents

What is an Income Tax Slab?

The Income Tax Slab is a system that determines how much an individual needs to pay in taxes based on their income. The amount of tax owed is determined by the tax slab in which the individual falls, with those earning higher incomes paying more taxes. The slab system was implemented to ensure the country’s fair and equitable tax system. The income tax slabs are reviewed and updated annually during the budget announcement.

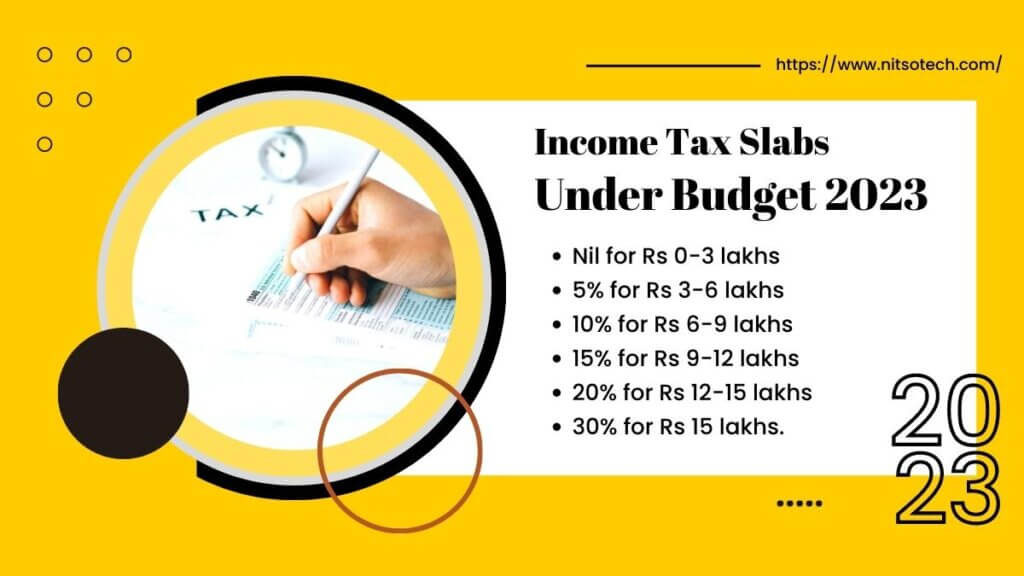

2023 Income Tax Slabs: Know the Latest Tax Rates Under the New Regime

- 0% for an annual income of Rs 0 to 3 lakhs.

- 5% for an annual income between Rs 3 to 6 lakhs.

- 10% for an annual income between Rs 6 to 9 lakhs.

- 15% for an annual income between Rs 9 to 12 lakhs.

- 20% for an annual income between Rs 12 to 15 lakhs.

- 30% for an annual income above Rs 15 lakhs.

Here are the 2022-23 Income Tax Slabs under the New Regime

- 0% for an annual income of Rs 0 to 2.5 lakhs.

- 5% for an annual income between Rs 2.5 to 5 lakhs.

- 10% for an annual income between Rs 5 to 7.5 lakhs.

- 15% for an annual income between Rs 7.5 to 10 lakhs.

- 20% for an annual income between Rs 10 to 12.5 lakhs.

- 25% for an annual income between Rs 12.5 to 15 lakhs.

- 30% for an annual income above Rs 15 lakhs.

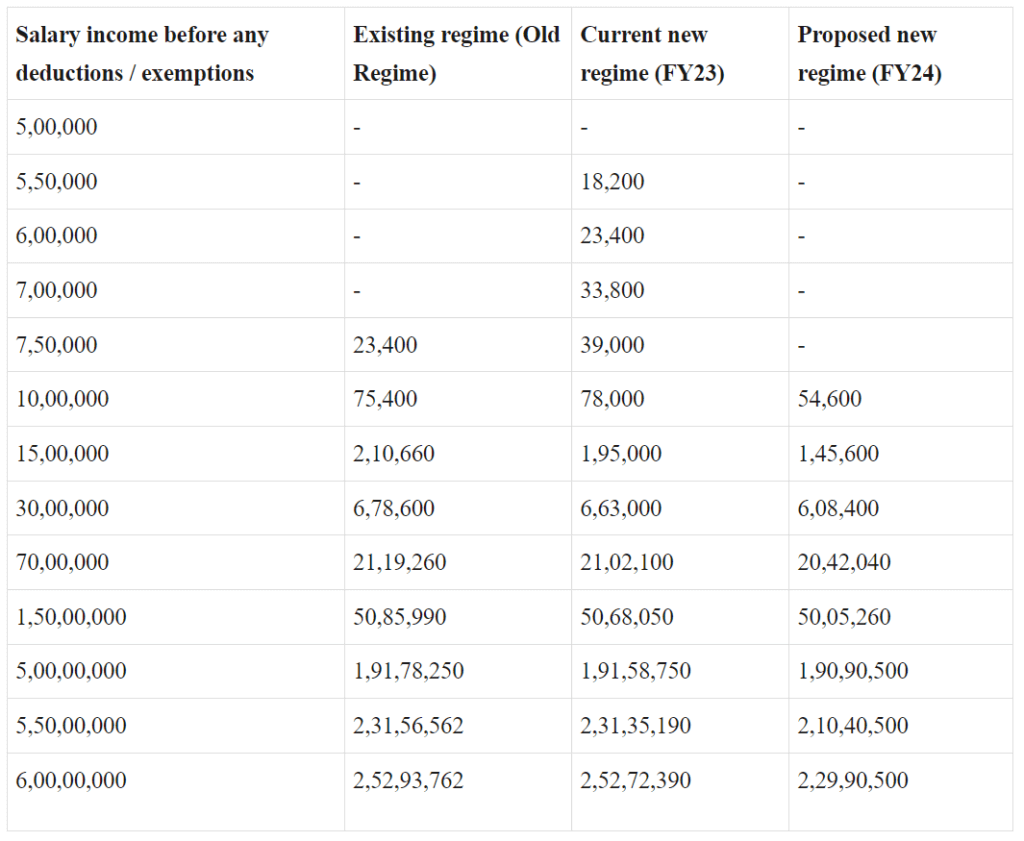

Comparing 2023’s New Income Tax Regime, Current New Tax Regime, and Old Regime

When deciding which income tax regime to opt for, it’s important to consider the amount of tax you would have to pay. The comparison between the existing regular income tax regime, the current concessional income tax regime, and the new income tax regime announced by FM Sitharaman in the Union Budget 2023 can be found in the table below. The calculations consider a total of Rs 2 lakhs worth of deductions and exemptions, including the standard deduction, under the existing tax regime. The table applies to resident individuals below 60 years of age.

Under the proposed new regime, a standard deduction of Rs 50,000 is available by default, similar to the existing tax regime. The new income tax slabs make more sense to opt for if you avail tax exemptions of up to Rs 2 lakhs, including the standard deduction. The changes in the new tax regime are expected to increase its popularity, especially for people with a salary income of up to Rs 7.5 lakhs, as their tax outflow will be nil due to the increased limit for rebates and the standard deduction.

In general, if an individual (with a salary income above Rs 15 lakhs) has deductions and exemptions exceeding Rs 4,25,000, the old tax regime may still be beneficial (for incomes below Rs 5 crores), but the analysis has to be done on a case-by-case basis.

Related articles:

Deductions and Exemptions: No Longer Claimable

Some of the Major Deductions and Exemptions No Longer Available under the 2023 New Income Tax Slabs System:

- Standard Deduction under Section 80TTA/80TTB

- Helper Allowance

- Professional Tax and Entertainment Allowance on Salaries

- Children Education Allowance

- Minor Child Income Allowance

- Interest on Housing Loan on Self-Occupied/Vacant Property (Section 24)

- HRA (House Rent Allowance)

- LTA (Leave Travel Allowance)

- Chapter VI-A Deductions (Section 80C, 80D, 80E, etc. excluding Section 80CCD(2) and 80JJAA)

- Other Special Allowances [Section 10(14)]

- Exemptions/Deductions for Other Perquisites/Allowances, including Food Allowance (up to Rs 50 per meal, two meals a day)

- Employee’s (Own) Contributions to NPS

- Donations to Political Parties/Trusts, etc.

- 2023 Budget Update: Standard Deduction of Rs. 50,000 for Years up to FY 2022-23 (Not available from FY 2023-24)

- 2023 Budget Update: Family Pension Income Deduction for Years up to FY 2022-23 (Not available from FY 2023-24)

What Exemptions and Deductions are Accessible under the New Tax Regime?

List of Tax Exemptions Available Under the New Regime:

- Tax-free transportation allowances for individuals with disabilities.

- Allowance for commuting expenses as part of the employment.

- Daily allowances for regular expenses incurred during absence from work.

- Compensation for travel expenses during transfers or tours.

- Perquisites for official purposes.

- Deduction for additional employee expenses (Section 80JJA).

- Exemptions for voluntary retirement, gratuity, and leave encashment.

- Deduction for the employer’s contribution to the NPS account (Section 80CCD(2)).

- Interest on a home loan on a let-out property (Section 24).

- Gifts up to INR 5,000.

- Union Budget 2023 added a deduction for contributions to the Agniveer Corpus Fund under Section 80CCH(2).

- A standard deduction of INR 50,000 was introduced in Budget 2023 for the new tax regime, starting from FY 2023-24.

- Budget 2023 also introduced a deduction for family pension expenses under Section 57(a).

Considerations before Choosing the New Income Tax Regime

Consider the following before selecting the new tax slab:

- Individuals or members of a Hindu Undivided Family (HUF) without business income can exercise the option before the start of the financial year.

- The choice is irreversible within the same financial year. If you change your mind and switch back to the old regime, you may opt for the new regime again in the same financial year.

It is essential to carefully evaluate your tax liability under the new and old regimes at the beginning of the financial year. Your investment decisions and calculations of TDS or advance tax payments will depend on your chosen tax regime. Remember to submit Form 10IE to the income tax department before filing your return if you choose to go with the new tax regime.

Example: A scenario where the new tax regime results in lower tax liabilities in FY 2023-24

Income (Rs) | Amount (Rs) | Old regime (Rs) | New regime (Rs) |

Salary | 1,250,000 | 1,250,000 | 1,250,000 |

Less: Standard deduction | 50,000 | 50,000 | 50,000 |

Less: Professional tax | 2,400 | 2,400 | - |

Gross total income | 1,197,600 | 1,197,600 | 1,200,000 |

Less: Deduction u/s 80C | 150,000 | 150,000 | - |

Total income | 1,047,600 | 1,047,600 | 1,200,000 |

Income tax | 126,780 | 90,000 | |

Add: Education cess @ 4% | 5,071 | 3,600 | |

Total tax | 131,851 | 93,600 |

In this example, for an income of Rs 12,50,000, the new tax regime provides significant tax savings of Rs 38,251 compared to the old regime.

However, if you take advantage of deductions for interest on a housing loan for a self-occupied property, health insurance, investment in NPS, education loans, etc., the old regime may offer more tax savings.

Example: When the Old Tax Regime is More Advantageous in Terms of Tax Payment (FY 2023-24)

Income (Rs) | Amount (Rs) | Old regime (Rs) | New regime (Rs) |

Salary | 1,000,000 | 1,000,000 | 1,000,000 |

Less: HRA exemption | 70,000 | 70,000 | - |

Less: Standard deduction | 50,000 | 50,000 | 50,000 |

Less: Professional tax | 2,400 | 2,400 | - |

Gross total income | 877,600 | 877,600 | 950,000 |

Less: Deduction u/s 80C | 150,000 | 150,000 | - |

Less: Deduction u/s 80D | 50,000 | 50,000 | - |

Total income | 677,600 | 677,600 | 950,000 |

Income tax | 48,020 | 52,500 | |

Add: Education cess @ 4% | 1,921 | 2,100 | |

Total tax | 49,941 | 54,600 |

Before deciding between the old and new tax regimes, it is crucial to consider your specific financial situation. For instance, in Example 2, an individual with an income of Rs 10 lakh and an HRA exemption and 80D deduction would save Rs 4,659 by opting for the old regime.

On the other hand, individuals with an income between Rs 5-15 lakh and minimal tax-saving investments may benefit more from the new regime. On the other hand, those who make substantial tax-saving investments may find the old regime more advantageous.

In conclusion, it is recommended that each taxpayer calculate their potential tax liability and consider their tax-saving investments before deciding on the tax regime to opt for.

Deciding Between the New and Old Tax Regime

- For income that triggers TDS, such as salary income: A worker can choose the new tax system at the start of the fiscal year, but once it has been selected, it cannot be switched back to the old system. The option to choose the tax regime can only be changed at the beginning of the following fiscal year.

- For income from Profession and Business: The choice between the tax regimes can only be made once for individuals with income from profession and business.

Under the new tax regime, deductions are not permitted for business income.

Business income not eligible for deductions and exemptions, including:

- Exemptions for SEZ units under Section 10AA

- Capital expenditure under section 35AD

- Expenditure on scientific research under section 35

- Sector-specific business deductions under sections 33AB and 33ABA

- Investment allowance under section 32AD

- Additional depreciation under section 32

Domestic Company Tax Rates under the New Tax Regime

Type | New Regime Tax rates | Old regime Tax rates |

The company that has opted for section 115BAB is registered on or after October 1, 2019, and has initiated the manufacturing process on or before March 31, 2023. | 15% | - |

Under Section 115BAA, a company calculates its total income without claiming specified deductions, incentives, exemptions, and additional depreciation. | 22% | - |

Companies opting for Section 115BA must be registered after March 1, 2016, and involved in manufacturing any item and cannot claim any deductions specified in the section's provisions. | 25% | - |

If a company had revenue of less than 400 crores in the previous fiscal year, 2018-19. | 25% | 25% |

Any other domestic company. | 30% | 30% |

The surcharge and cess that will be levied in addition to the tax rate:

- Surcharge: 7% for taxable income over Rs.1 crore but less than Rs.10 crore and 12% for taxable income over Rs.10 crore.

- Cess: 4% of corporate tax

- Non-resident Indians: For non-resident Indians, the exemption limit is up to Rs.2.5 lakh, regardless of age.

Essential Points for Tax Surcharges and Cess on Income:

- 10% surcharge on net income between Rs.50 lakh to Rs.1 crore.

- 15% surcharge on net income above Rs.1 crore.

- 4% cess on the total tax amount, an increase from last year’s 3% cess.

What is Surcharge?

A surcharge is an additional tax levied on individuals and companies whose taxable income exceeds a specific limit set by the government. It is calculated as a percentage of the income tax payable and is imposed to increase the government’s tax revenue. The surcharge is applied on top of the standard income tax rate and applies to both individuals and companies. The surcharge amount is determined based on the taxable income and the income bracket in which the individual or company falls. The surcharge rate is usually higher for higher-income groups. It is important to note that the surcharge is not a permanent tax and is subject to change based on the annual budget announcements.

What is Marginal Relief?

“Marginal Relief” refers to relief from the surcharge, given when the amount of surcharge owed exceeds the amount of income that makes the individual liable for the surcharge. This relief ensures that the amount payable as a surcharge does not surpass the income earned over the thresholds of ₹50 lahks, ₹1 crore, ₹2 crores, or ₹5 crores, respectively.

What are Health and Education cess?

The health and Education Cess is a tax imposed by the Indian government to finance healthcare and education initiatives in the country. It is levied on the amount of income tax payable and is calculated as a percentage of the income tax liability. The current rate of Health and Education Cess is 4%. It is collected by the government along with the income tax and used to fund social welfare programs and infrastructure development initiatives related to healthcare and education.

FAQs on Income Tax Slab

Do I need to file ITR if my income is below Rs.3 lakh?

Yes, you do not need to file ITR if your yearly income is below Rs.3 lakh under the new regime, but it’s recommended to file a ‘Nil Return’ for record-keeping, as you may need to produce them as proof of employment while applying for a loan or passport.

How is the taxpayer’s income classified?

A taxpayer’s income is classified into five different heads, namely Salaries for individuals, Capital gains, Gains/Profits from business or profession, Income from house property, and Income from other sources, as per Section 14 of the Income Tax Act.

Will family pension be taxed under salary income?

The family pension will not be considered part of salary income and will be taxed under the category ‘Income from other sources’.

Who can claim a rebate under Section 87A?

Rebate under Section 87A can be claimed by resident Indians whose total income does not exceed Rs.7 lakh per year under the new regime.

Will agriculturists’ income be taxed?

Income generated from agriculture and its allied activities will not be taxed. However, it will be considered for rate purposes while calculating the tax on non-agricultural income.

Can I switch between the old and new tax regimes?

Yes, depending on your preference, you can file ITRs under either the old or new tax regime.

Is the Indian income tax structure subject to alteration?

Yes, the Indian income tax structure can be altered. Who determines changes to the Indian income tax structure? The changes to the Indian income tax structure are proposed by the Ministry of Finance in India.

When are the changes to the income tax slabs proposed?

The finance minister proposes the changes to the income tax slabs during the annual budget, which is usually announced in February each year.

Is it better to be under the new tax regime?

It depends on the individual’s total taxable income, deductions under Section 80C, 80D, HRA exemptions/housing loan, etc. A comparison between both regimes should be made to determine which regime will yield better results for the individual.

Is Section 80C applicable under the new tax regime?

No, the new tax regime does not include deductions under Section 80C.

How to calculate tax under the new regime?

To calculate tax under the new regime, take the total gross income after subtracting the standard deduction of Rs.50,000. Then, if eligible, claim deductions under 80CCD(2) or 80JJA and compute tax according to the slabs on the net taxable income. If eligible, claim a rebate under Section 87A. Finally, add the cess of 4% to the tax to get the total tax payable.

Is HRA exemption allowed under the new tax regime?

No, HRA exemption is not allowed under the new tax regime.

Is standard deduction allowed under the new tax regime?

Yes, a standard deduction of Rs.50,000 is allowed for salaried individuals from FY 2023-24 (AY 2024-25) onwards, as per the Budget 2023 proposal.

What deductions are allowed in the new tax regime?

Deductions allowed include the standard deduction (starting from FY 2023-24), contributions to the Agniveer Corpus Fund (starting from FY 2023-24), expenses for family pension income under Section 57(iia) (starting from FY 2023-24), transport allowance for persons with disabilities, employer’s contribution to NPS, additional employee costs, and a few others listed in the previous section.

What deductions are not allowed in the new tax regime?

Deductions not allowed include those under Chapter VIA – Section 80C, 80D (health insurance premium), 80E, and others, except for Section 80CCD(2) and Section 80JJAA and those listed in the previous section.

Is bank interest income taxable under the new tax regime?

Yes, bank interest income is taxable under the new tax regime.

What is the minimum annual salary required to file an ITR?

The minimum annual salary required to file an ITR varies based on the individual’s age and other factors.

What is the maximum amount of income exempt from taxes under the new tax regime?

The maximum amount of income exempt from taxes varies based on the individual’s age and other factors.

What are the advantages of opting for the new tax regime?

The advantages of opting for the new tax regime include a lower tax rate and the elimination of certain exemptions and deductions.

What are the income tax slabs for the financial year 2023-2024?

For the 2023-2024 fiscal year, the tax rate for annual incomes in India is as follows: those earning between 0 and 3 lakhs are exempt from tax, those earning between 3 and 6 lakhs are taxed at a rate of 5%, those earning between 6 and 9 lakhs are taxed at 10%, those earning between 9 and 12 lakhs are taxed at 15%, those earning between 12 and 15 lakhs are taxed at 20%, and those earning over 15 lakhs are taxed at 30%.

What tax year are we currently filing for in 2023?

We are currently filing for the financial year 2022-2023.

What deductions and exemptions are available under the new income tax regime?

Under the new income tax regime, there are several deductions and exemptions available to taxpayers. One of these is the standard deduction, which allows individuals to reduce their taxable income by a fixed amount. Another exemption is the expense incurred towards income from a family pension, which is eligible for deduction from the total taxable income. Additionally, a transport allowance for specially-abled persons is also available as a tax exemption. Another benefit for employees is the deduction for the employer’s contribution towards their National Pension System (NPS) account. There are also a few other deductions and exemptions that individuals can avail, as per the provisions of the income tax laws.

Is home loan interest deductible under the new tax regime?

Yes, the home loan interest is deductible under the new tax regime.

0 Comments